Q1 2022: Procurement & Supply Chain Recruitment Market in Switzerland

As we enter the second quarter of the year, John Byrne, Country Director, takes a look at the Procurement & Supply Chain recruitment market in Switzerland since the start of 2022…

Another very busy quarter for all involved! I don’t recall a period with such a consistency of topics raising crisis management demands and solutions across the Procurement and Supply Chain disciplines.

With these ever-changing demands placed upon you all, it has maintained a strong and stable need from our clients and candidates alike to support on talent gaps, talent development and general market mapping exercises to help maximise each of our clients' position in their market.

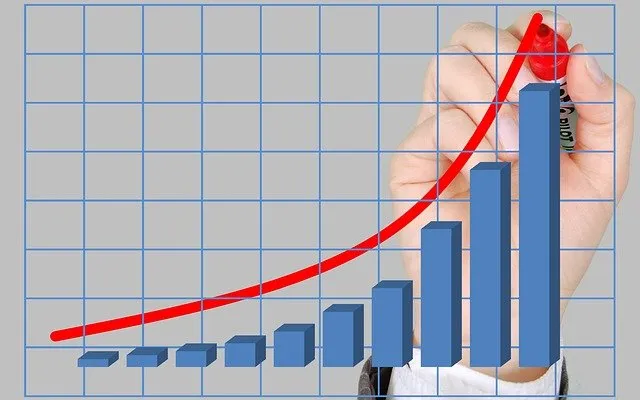

The number of assignments we partnered with clients on last quarter rose sharply, resulting in our vacancy completion rate also rising. Last quarter saw an increase of 23% on the previous quarter, closing our financial year 27% up on last year. This is the seventh successful YOY growth - this represents a consistent desire from our clients here to keep strengthening their teams and their offices throughout Switzerland.

We are now able to get back amongst our clients and candidates again throughout the last quarter on a far more consistent basis than before, with offices opening - and we fully expect this to gain further momentum as we approach the summer period.

This is becoming more and more important as the talent market continues to seek a stable balance between work versus lifestyle desires - something we anticipate will take the remainder of this year to stabilise. Hybrid working is here to stay from the consensus of our network, so we are working hard with both our clients and candidates to understand the most productive methods for both.

If you wish to have a discussion about how this is impacting the middle to senior recruitment market, then please reach out for a confidential discussion: [email protected]

Q1 2022: Insights into Switzerland's Finance Employment Market

Despite the current working from home restrictions and the rising COVID-19 case numbers, the start of 2022 feels much more positive than 2021 in Switzerland's Finance employment market, as businesses have learnt to adapt to different ways of working and confidence remains high.

Although recruitment slowed slightly in December, it was only to the level that is normally expected at that time of year and the first quarter of the year is likely to see a growth in opportunities available within Finance & Accountancy.

What happened in Q4?

We saw further evidence of the competition for talent and many candidates found themselves in the fortunate position of having a choice of job offers to choose from, including counter offers from their current employer, due to the desire and need to retain talent.

The temporary work from home restrictions raised the subject of hybrid working again and businesses requiring four or five days in the office found that their choice of candidates was more limited. Should this trend continue, then companies recruiting 100% office-based employees will seriously damage the quality of their workforce.

Following on from our market insight article in July 2021 around increasing interest in candidates with strong data visualisation experience, we have seen a rise in the number of employers asking for Finance professionals with advanced skills in Power BI, Tableau and other such packages. When we have identified good candidates with this profile and taken them to market, there has been a positive response, resulting in both interviews and placements.

One of the things that has become increasingly apparent, but over a much longer period of time, is that the continued relocation out of Switzerland of transactional and more junior Finance roles at international companies has made recruiting at this level far more difficult, as the audience for these roles has reduced in size.

What do we expect in 2022?

Businesses have been dealing with change due to COVID-19 for nearly two years, and have introduced new working practices and methods to ensure continued operation and progress. This improved change management capability, coupled with the mitigation of COVID-19 impact provided by vaccines and boosters, suggests that 2022 will be a stronger year than 2021, with more opportunities for Finance professionals.

Competition for staff will remain strong and may result in pressure on salaries and benefits, as candidates have more options available to them.

How can EMEA Recruitment help you?

In a market that is changing quickly, the most valuable commodity to both job seekers and employers is timely and accurate insight. As specialists in Finance recruitment in Switzerland, the Finance & Accountancy team at EMEA Recruitment has this in abundance and is happy to share with both candidates and clients.

If there is anything you would like to know about the market, to either help you plan your next career move or to assist you in recruiting more effectively into your business, we would be happy to talk to you: [email protected]

Q4 2021: The Finance Employment Market in the Netherlands

Throughout Quarter 4 2021, the Finance & Accountancy employment market for job seekers remained strong in the Netherlands.

EMEA Recruitment has seen, across the board, a desire for a more hybrid working life amidst the continuing work from home requirements. We have also witnessed a trend in job applications falling and the need for a more direct approach within the market in order to attract the most suitable candidates.

From an employer perspective, there has been a continuous need to streamline and improve recruitment timelines to avoid missing out on desired candidates who are in multiple processes. As a result of this, high levels of competition for talent are pushing salaries upwards. This is particularly reflected at the more junior end of the market, with Accountants, Payroll Specialists, Financial Analysts and VAT Specialists remaining in high demand. As ever, there is a continued need for Dutch or German-speaking candidates within the market at this junior end.

If we look towards the more senior end of the market, we have seen an increase in candidates looking for new opportunities, but recruitment processes becoming more protracted as companies are biding their time in order to hire niche skillsets.

The demand for talent has been most prevalent within sectors focused on production, pharmaceuticals, bio tech and energy.

What do we expect in 2022?

2021 was dubbed the “great resignation”; we saw an increase in more passive candidates open to considering new opportunities. This - coupled with employers feeling more confident with the economic stability and growth within the Netherlands - saw an increase in opportunities across Finance functions.

Despite the impact of COVID-19 continuing into 2022 and the return of full-time WFH, we predict that the employment market within the Netherlands will remain buoyant. Employers will have to continue to adapt to the world post-COVID. Optimism is strong and many employers are focussing on a balanced work life and reward strategy to improve staff retention and wellbeing.

If you’d like to discuss the market with us further, please don’t hesitate to get in touch: [email protected]

Q4 2021: Switzerland's Finance Market of 2021 so Far

As we enter the final quarter of 2021, it seems a good time to look at how the Finance market in Switzerland has evolved from the perspective of both job seekers and employers.

Q1

Job Seekers – more opportunities advertised direct, but high volumes of applicants and a frustrating lack of feedback when applying for roles.

Employers – a focus on advertising direct, rather than using recruitment consultancies, to save cost and take advantage of candidates needing work. The high application volumes masked a decline in relevance, as individuals who had been displaced were forced to apply for a number of jobs to maintain their support.

Q2

Job Seekers – as lifestyles were reviewed post-COVID-19 and the return to the office got nearer, the working from home factor became more important for candidates.

Employers – competition for talent increased and we saw more counter-offers from employers trying to retain employees. Companies unable to offer work from home flexibility struggled to attract high quality individuals. More recruitment processes required support from recruitment consultancies.

What happened in Q3?

Job Seekers

- An increase in career moves from passive candidates, but a preference to work with recruitment consultancies, rather than applying direct, partly due to time restraints, but mostly due to very specific career aims

- More opportunities for good candidates, resulting in multiple offers for some

- Counter-offers by current employers are being experienced more frequently

- Frustrations about directly-advertised positions – particularly relating to salaries

- Negative employer brand experience, due to the lack of feedback from direct applications

Employers

- Unexpected vacancies appearing as passive candidates re-engaged their career plan and started securing new roles

- High levels of competition for talent resulted in some upward salary pressure

- Work from home policies were challenged by potential employees

- Recruitment timelines needed to be shortened to avoid missing out on desired candidates

What do we expect in Q4?

As the impact of COVID-19 reduces, the new normal becomes clearer and business confidence increases. Many projects and developments that were put on hold are now being brought back into current plans.

All of this is good news for Finance candidates seeking new opportunities, but it means we will see more movement in the Swiss market, as individuals who have been happy to sit tight for the last 18 months put their career plan back into action.

How can EMEA Recruitment help you?

In a market that is changing quickly, the most valuable commodity to both job seekers and employers is timely and accurate insight. As specialists in Finance recruitment in Switzerland, the Finance & Accountancy team at EMEA Recruitment has this in abundance, and is happy to share with both candidates and clients.

If there is anything you would like to know about the Finance market in Switzerland, to either help you plan your next career move or to assist you in recruiting more effectively into your business, we would be happy to talk to you.

Get in touch with the Country Director, John Byrne: [email protected]

Which Procurement Skills are In Demand?

With Procurement under increased pressure, the skills that are in demand are changing...

As a result of multiple factors, including, but not limited to COVID-19, Procurement departments have experienced significant stress in the last 18 months, and this is predicted to continue, especially within a number of harder hit direct material commodities and those industries subjected to continued oil and gas price fluctuations.

Material availability, price increases, volatility and supply chain disruptions have all come to the fore, creating a perfect storm within Procurement & Supply Chain. This has highlighted the need for Procurement leaders to develop or seek different skillsets. Before this disruption, commercial ability, stakeholder and relationship management, understanding of data and digitization, and cross-functional integration were all desirable skills, but now they are becoming essential for our clients.

To survive in the new market, Procurement leaders need to be predictive and agile. They need to understand trends and integrate cross-functionally now more than ever. The challenges brought mean the skills that Procurement leaders were discussing as highly desirable or skills for the future are skills for now; they are becoming the basic toolkit Procurement professionals need to navigate a new landscape for the coming years.

Our clients are seeking influencers, not the traditional strong negotiator – just being price focused, negotiating tough rebates, liabilities etc. are given hard skills, but they won’t build Procurement’s influence across the wider organisation. In the new landscape, a strong negotiator is someone with the capability to understand internal and external requirements and foster long-term partnerships; it’s an individual who can identify mutual wins while combating risks and protecting profits through market trend planning.

Growth of the global, commercial mindset

When availability of materials is low and competition is high, risk reduction and profit protection isn’t as simple as diversifying the supplier base or last minute alternate sourcing, and this is where the benefits of the new skillset arise.

Being innovative, proactive and anticipating change or challenges is also increasingly important. Being able to identify potential issues before they arise has always been a great benefit, but with the digitalization of businesses as a whole, and swathes of new data and ways to use this becoming available to Procurement leaders, the playing field is definitely not even.

Successful Procurement leaders need to be relationship-focused, data-driven and able to use new technologies to allow their businesses to become more integrated and agile.

For more information on how to upskill your workforce, yourself or simply to understand where your specific industry trends are heading regards talent attraction, please get in touch: [email protected]

Q3 2021: Finance Market Update in Switzerland

Following the first two quarters of the year, we have insights on the Swiss employment market for Finance & Accountancy professionals…

The recovery continues! Q2 2021 saw a continued increase in the number of Finance opportunities in Switzerland and further evidence of movement at more senior levels.

Business confidence is growing; some industries are already seeing increased revenue, either from traditional markets or as a result of exploring new markets, due to a more agile approach developed through changes forced by the pandemic.

Flexibility within the Workplace

As we prepare for a return to a more normal life, the question of flexibility is high in the agenda of both employees and employers. Our recent Swiss employment market poll on employee working preferences produced a startling change in attitude over the last eight months:

| Oct 2020 | Jun 2021 | Change | |

| 1-2 days from home, the rest in the office | 47% | 42% | -5% |

| 3-4 days from home, the rest in the office | 38% | 43% | +5% |

| 5 days from home | 10% | 11% | +1% |

| 5 days in the office | 5% | 4% | -1% |

The June 2021 poll produced the highest engagement levels we have ever seen on LinkedIn, but we were surprised to see such an increase in those wanting to work 3-4 days from home, compared to the previous top ranked answer of 1-2 days.

When comparing to employer sentiment, it is noticeable that most company return-to-work announcements have focused on three days in the office, highlighting an obvious difference in expectations between employees and employers.

After the return to the office happens, we may see a change of view from individuals, as they get used to commuting and engaging with colleagues, but either way, flexible working will be a hot topic for some time.

How is this Impacting the Swiss Employment Market?

We have already experienced candidates rejecting job offers due to lack of flexibility being offered by new potential employers. Once working from home conditions end, we are expecting to see an increase in candidates entering the marketplace if employers are not prepared to accommodate flexible working.

In the meantime, companies offering enhanced flexible working arrangements are likely to have a competitive advantage in the market, which will assist with both retention and attraction.

Market Hotspot

We have seen a significant increase in Finance roles requiring skills with data visualisation tools, such as Tableau, Power BI and Qlik suite. Considering the small candidate population with significant exposure to this software, we predict a battle for talent in the coming 12 months, as companies assess rapidly changing marketplaces.

EMEA Recruitment has led Finance in Technology events in the region over the past few years and is therefore well-positioned to discuss any plans you are considering in this area.

If you are a candidate with experience of any of these tools, we would like to hear from you immediately regarding Finance opportunities in Switzerland: [email protected]

EMEA podcasts

The EMEA Recruitment podcast welcomes guests from across our network and beyond to share their career journeys, advice, and inspirational stories.

You can also use your social account to sign in. First you need to:

Accept Terms & Conditions And Privacy Policy