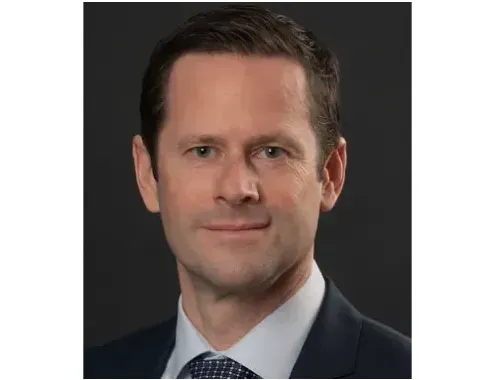

Holger Ruckstuhl - Head Group Corporate Finance at Sulzer

Holger Ruckstuhl is the Head Group Corporate Finance at Sulzer in Zurich, where he’s worked in various roles for 15 years. He started his career as a Tax Manager at Arthur Andersen & Co., before moving to EY and Siemens.

What excites you about working for Sulzer?

On one side, Sulzer is a company with a long history, a lot of legacy, and I have known of the company since my youth. It is an industrial company with tangible products that are highly engineering driven.

On the other side, it's a company that has always reinvented itself.

Our focus has been on traditional industrial products - quite strongly in the oil and gas business - whereas now we are trying to turn the business into a more renewable business that is CO2 capturing and so on. What we are trying to use is the technology we have developed for more traditional applications, so that they can be applied in the new applications, which is slightly more economically friendly – for the environment, as well.

As an example, the recycling of clothes is one of the biggest and most challenging topics you can imagine. Sulzer is working with other companies from the fashion industry to make efficient recycling of clothes happen.

We are building a plant here in Switzerland to scale up what is currently working in other laboratories, so that we can show it to our stakeholders and to the customers; the recycling of clothes makes sense.

This is an area that I think could enable a lot of change to the environment, because the fashion industry has the most negative footprint on Earth.

The other thing is CO2 capturing. We have developed a technology where we can take out the CO2 when it is produced in a coal-fired or gas-fired powerplant. Bringing this to the market and convincing the customer that they should use it is the challenge we have.

The next challenge is we have to develop the technology. If you have captured the CO2, it has to be stored. We have developed the technology to store the CO2 in limestone. Here, we are currently working with another Swiss multi-national to scale it up and bring it to the market.

Limestone can be reused for other applications. Otherwise, currently, when you capture the CO2, one of the ideas is to put it into the ground - especially where we have taken out the oil - and to fill the holes in the ground with CO2.

This is one option that might become a dangerous one. But, if you put it into limestone, it will not disappear anymore; it will then become trapped and become part of the limestone.

Sulzer is an engineering company with a lot of technology and very tangible products, and that's what I like to work with.

Then, it's the cultural aspect. We are a Swiss-headquartered company, but we have a very international culture, with a little bit of Swiss-ness in it; we are active in about 60 countries.

What are the aspects that will protect the future of the company?

It's the way we think in Switzerland. I'm Swiss, so therefore it's not so easy to talk about our own culture.

It's really thinking in longer-term cycles to value people and their different aspects. Switzerland is one country, but we are divided into 26 cantons and we speak four different languages - if you now take English in addition, then we have five different languages that most people in Switzerland speak. These are also different cultures in Switzerland. I would say this is what you're bringing into other international companies headquartered in Switzerland.

What changes have you seen to the employment market?

Especially when we're interviewing younger people, more or less coming from university or having only two or three years of working experience, the demands they have towards an employer have increased, in terms of value, flexibility, compensation, having teams composed by different genders, cultures, people coming from different countries…

Also, especially in current times, it's clearly an employee market for the time being. We are looking for talent and the talent is limited. Even if I think that Switzerland is an attractive country for foreigners, we have to fight for talent – and, clearly, they know it.

On the other side, I have no problem with younger people saying, “I want to have this, this and this…” I think it's good when younger people are clear on what they want.

However, if they are demanding, from time to time, they should also accept that the employer is demanding on flexibility - how they have to work, that you cannot only work from the home office, but you have to be present in office, as well. Also, there might be occasions where you have to work longer hours in the evening and so on. From time to time, I see a certain disconnect of what people are demanding and what they are willing to give to the employer. I think this needs to be bridged and they have to be fair.

Since we have more home office working - and I think this is a very good development - I personally like to be in the office, I have to say. Everybody has a computer, everybody has an iPhone or something; you can work from wherever you want to work, but you are reachable, as well.

However, there is a bad development in what is expected from an employer, because of the flexibility. The demand is 24/7 - independent of if you’re on holiday or not, you can be reached.

The employer thinks, we give the employees more flexibility to do what they want, but they have to accept our flexibility that you are always reachable and available in case someone needs you. I think managing this is a big challenge for the future.

Can you think of any ideas that could help that?

As a manager, you have to accept that your employee is on holiday and that you really distinguish what is super urgent - maybe you desperately need feedback from your team member, but can it wait another couple of days?

It is easy to send an email or a WhatsApp message. As a manager, you have to limit the easy means of communication that can bother your team members when they're on holiday, or if they have taken off a couple of days or even over a weekend.

Also, you should not send out emails over the weekend saying, “By the way, I only need this information on Monday morning,” because most employees then feel pressured that they have to feed back to you on Sunday evening. As a manager, you have to accept the privacy of your team members and colleagues.

Have you always been like that or have you developed because you know what works and what doesn’t?

I try to be like this, but - in the last 12-18 months - there have been so many occasions where I have had to call my colleagues during holidays. I even once asked one of my team members to move holidays and they have been willing to do so, but this must be extraordinary. I feel myself - and even if I look into my company - that this has become standard, and I think this is not the right development.

On the other side, the higher you are in the hierarchy, the less this is respected - maybe this is becoming part of your job, but even the CEO or CFO cannot work 24/7, 365 days a year. I see this becoming a new culture that is going in this direction.

I have good breaks. Nevertheless, I always have my computer with me and I regularly read my emails.

Do you have particular things that drain your energy and then, on the other side, particular things that allow you to focus?

Firstly, I have a family. For me, my family is a source of energy, even if it's not always easy. My two daughters are 16 and 14; they are at a good age and most of the time we get along well.

On the other side, I focus the bad energy that I have from time to time on doing sports, like cycling, mountain biking, things like this. They are more long-distance activities, so I’m away from the family, but this helps me stay fit and clean up my mental situation. It gives me more back in the end and makes me feel much better when I’ve done it. This is how I try to cope with the stress and pressure you get as a senior manager in a multi-national organisation.

What makes life difficult is managing quite a big team. Therefore, you have to be structured, and most of my days are structured by meetings. What really sucks away my energy is when the CFO arrives unannounced, completely flipping my daily schedules without any warning.

When that happens, you feel stressed that you have to do something for your CFO, and all the topics you planned for the day, you have to now do in the evening – or even in the night - or you have to move it to the next day, but the next day is also partially booked.

How you organise your days and your interaction with your team members needs to be structured. What I do not like is the bottleneck and this happens when someone takes away your time unexpectedly, and you end up becoming the bottleneck for many other people. I don't like it; you can also see your team members become stressed, because they cannot execute all their activities, because they have a tight schedule, as well.

It's how you organise the massive load of work you have in a particular manner. Clearly, from a manager point of view, I cannot be a micro-manager, otherwise I would need more than 24 hours a day.

What is your management style and how do you feel that works for your team?

I have a collaborative working style. I'm trying to be the primus inter pares; I respect my team members in such a manner and I encourage my team members that they take responsibility for their own areas.

My team members have defined areas. For me, they are the specialist or the manager in the area, and they have to manage these areas independently. They have clear targets, they have clear goals, they have clear objectives, and - as long as they are able to manage the objectives according to my expectations - I give them a lot of freedom. I don't care how they achieve their objectives, as long as they reach the objectives. This is also how I want to be managed.

Also, I try to help my people and coach them if I think they could do it better, or they could organise themselves better, but I’m not a person that says, “You have to do it this and you have to do it like this.” For me, it's more that you achieve your objectives in the given timeframe, but how you achieve the objectives is up to you and it’s individual.

Additionally, I'm a team player. I like to have a team. But, in the end, if a decision needs to be taken, I will take the decision and I will take responsibility for the decision I've taken.

I like the collaborative work style, giving freedom to my people to develop themselves, because - in the end - I would like to see that people are developing in their current function, so that once they become a better leader, or if they are specialists, they can grow in a particular area.

We have a good level of openness and trust with my current team, so I think they come to me whenever they need support or help.

I also criticise my team members. But I think you can criticise someone, it's just how you criticise someone. For me, it's important. Clearly, I'm not completely new in my current role and my team knows me. I also have a new team member now and I was extremely open with him, as well.

He came from a bank, and he said he was not used to working like this; the bank was much more hierarchical. I said, “This is the working style I have, and it’s always going to be different compared to a bank, but we are working as a team,” and I said that he has clear objectives, targets, and he knows about the way he has to do work.

I review our progress on targets, but as long as I have the feeling the other person is doing their job right, I think there is no intervention needed from my side.

For me, the personal objectives or goals I have for the year are some of the objectives of my employees, and, therefore, we are completely aligned from that perspective.

How many people do you have in your team?

I have 12 direct reports. I'm leading a couple of teams. I have a full Treasury team - we have seven here in Switzerland, but then we also have direct reports in the UK and in the US, and we have a bunch of people in India, not directly led by shared service.

I am also leading the headquarter’s Accounting team - there’s about 20 people. They are not all reporting to me; I have the Chief Accountants reporting to me. On this floor, we have the Treasury and Accounting team, then I'm also managing Financial Services on a global scale. This is a team of about ten people in house, and some people are outsourced to an outsource provider in India. Indirect Procurement is now currently also under my leadership share.

For the time being, I would be happy if my team was not growing, I have to say. But my full focus currently is really on the Treasury team, because we had to reshape the team.

How did you find the market for Treasury when you were going through that process?

We have hired in quite a special way; we hired a colleague of another colleague who had already been with us. Therefore, we have taken the shorter route, but we knew who we had hired. This was not really a real recruitment process - we just saw the profile, we knew the person was available and therefore we have recruited him. He was a perfect match. We also had a meeting in the team and then we recruited one real new member.

Also, it was quite a special role we looked for. We had about 80 CVs coming in - most of them were not according to our expectations, and then we had a couple of interviews. In the end, we had two or three suitable candidates. This was not the standard recruiting process.

What risks have you taken throughout your career and how did they help you get to the level that you’re at now?

It’s not a risk, but for me it was always important to be your own personality. Do not change too much. From my point of view, you have to stay as you are. A risk could be that you're not adopting a certain style.

On the other side, from a risk perspective, I try to be honest with my superiors, and I have been successful in providing critical feedback to my superiors and they have accepted this. Over time, that has improved my standing, because they know that I'm a critical, independent person. But this is not always easy, that's clear.

I think you have to sense when it's the right time to come up with criticism against your superior. Nevertheless, if you're brave enough, this is something I would always recommend doing. It’s more how you do it, and this is important.

One the other hand, last year, I took an important decision for myself. Within my Finance background, I'm a tax lawyer, and I was leading the Tax department for more than 14 years of this group. The last time I took an important decision was when I handed over the responsibility for my Tax team and instead took over group Corporate Finance - mainly Treasury. I'm not a Treasury specialist, but this was an easy decision for me. I had to more or less leave my home turf and focus on a different position with different skillsets within Finance.

I had worked for more than 20 years in Tax and had 14 years’ experience within the same organisation. In 2021, we went into a spin-off activity with one of our divisions.

I had to ask myself if this was a job that could challenge me for the next ten to 15 years. I had the opinion that this job would also become slightly boring, with not too many challenges.

Then, I had only two options: to look for a similar job within another organisation, or to do something completely different within Sulzer. I was in a lucky position that the CFO left, the Group Treasurer became the CFO, and I took over the position from the current CFO.

Do you think your love of mountain biking – quite a risky sport - helps you within the workplace to overcome things that you might not otherwise do?

That could be the case. I do quite intensive mountain biking here in Switzerland. It is sometimes dangerous, and you always have to take a decision and assessment - challenging yourself to a certain level, but not over challenging yourself so that you might fall.

It is a very physical sport, it's quite technical. You have to overcome the fear you have.

Especially when you are going downhill, you have to take decisions very fast and it's better to take the right decision. Maybe this also helps to take decisions in business, but it was also clear to take over this particular position with so many different teams. To do the same with a completely new organisation would have been much more challenging.

With Sulzer, I more or less knew all the people. I knew the culture, the senior management, and the people knew me, as well. Therefore, even if it's a completely new Finance function, new department, with new skillsets - especially technical skillsets - I think it was doable and it was a very good challenge.

It was a hefty one in the beginning; I worked long hours, but it was the challenge I was looking for.

From time to time, you have to challenge yourself, deciding whether to take over something new or similar within the same organisation, or look for a challenge in another organisation.

Clearly, if you're passionate about a company, I think it's easier to go through these slightly more difficult times than with a new company.

Do you read or listen to podcasts in your spare time?

I do not listen to podcasts too often, but there is one particular Swiss podcast from the Swiss radio, between six and eight in the evening. Very often, I listen to this podcast when I’m driving home. It’s in German. It's extremely good, I have to say.

I read books, but more when I'm on holiday and relaxing. I do not read self-development books, such as how to become a better manager. When I read, it is just to relax, to enjoy, so normally it's when I'm on holiday.

During summer holidays, I'm normally in France, in the Britannia, and therefore I like to read crimes from the Britannia, because then you can really feel where it is; it could be just next door and it’s like you’re in the story. You can see yourself in the story, as well.

Obviously, a lot of companies are looking at sustainability at the moment. Tell me about what that looks like in your sector or industry.

For Sulzer, it's crucial that we are developing away from the current oil and gas business to more sustainable business activities. To grow the business in a more sustainable way is a growing market force and we are one of the first movers or technology leaders, so we see a quite a lot of market potential there. Whereas the oil and gas business is actually a dying business over time - not today, not tomorrow, but in the mid/longer term.

On the other side, to be seen as an oil and gas company ten years ago was an asset. Today, it is not, also from an investor’s perspective. That is because more and more investors, banks, pension schemes have a clear ESG (Environmental, Social and Governance) and sustainability agenda, as well. At some point in time, they will not be allowed to invest in a company like us if we do not change our business model or the focus area where we want to grow.

Therefore, it's a combination of what we see in CO2 carbon capturing and recycling, and we are very strong in the water business - especially in the waste water treatment business, which is a mega-trend.

Currently, we have a lot of waste water treatment in Switzerland and America, but you'll see it in India, as well. You’ll see it in China and, at some point, also in Africa or other Asian countries. Therefore, it goes hand in hand.

You have to focus on more of a sustainable business and leave behind the traditional old oil and gas business - even if you’re not only an oil and gas business, but it has formed a big part of us. Many investors still see us as an oil and gas company, even if we’ve been trying for a couple of years to explain that it is part of our legacy, but is not our future. We are moving into other areas; we want to further grow into more sustainable environments.

On the other side, the banks are also asking, “What is your sustainability strategy?” We have already seen, for a bigger job we have executed in the oil and gas business, a particular bank was not willing to provide the bank guarantee, because they have a clear internal guideline that they are not supporting that kind of business anymore. Therefore, this might limit your business over time. It requires a refocus and a consideration for sustainability.

We clearly have it as part of our long-term strategy: to become a fully sustainable company.

What have you put in place to ease that conversation and the image of the company?

On one side, you have a current portfolio of businesses and resources. Then, the strategy is in which business to invest most of your cash into. Would it be by internal growth, organic growth or by acquisitions? It is clear that you will mainly focus on a sustainable area, which is the water business for us.

It's also the business of our kinetic division, where we see more green technologies - recycling the production of fuels, CO2 neutral fuels… really modern technology and moving away from the traditional industry we have.

We have started the journey that the focus will be on sustainable business.

For the time being, we are not willing to sell the gas businesses; we still believe it's an important industry to offer. Obviously, it would be nice if everybody only had electric cars and maybe would not heat their houses with gas or oil, but - in Switzerland - the majority of homes are still heated with oil or gas.

This will probably be the case for the next ten to 20 years, until we are producing enough electricity for everybody to only have electric cars and to heat with electricity. But, for the time being, this is wishful thinking. Additionally, we see it as our duty to help bridge the time until we are able to live without fossil, oil and gas - that’s how we are currently doing it.

How will digital transformation change the role of Corporate Finance?

A huge topic is that we are collecting more and more data from our source systems. We are using more technology, which is becoming more difficult, but the technology or the tools are more connected, so you have to become an IT specialist.

On the other side, because we are managing our own tools, I have IT people that have an education in IT, as well as Finance, so we can manage our own tools and develop our own ideas about where we want to develop.

When it comes to our Treasury management system, it’s about what we want to connect. For example, we are onboarding a new bank in a particular country with new bank accounts. This is a traditional Treasury topic, but this account now needs to be automatically linked to our ERP system.

In this case, there are three different pieces - two SAP and one is Microsoft Dynamics. Now, you have to bridge the know-how from the bank. They have the IT guys say, “We have this kind of technology - the information which flows from the bank to the ERP system must be in this kind of format.”

Now, you have to talk to IT, they have to program on your side, and you can see it’s not only you who can say, I have a bank account, I have an ERP system, and therefore you have to help and guide.

That means you need to have a better understanding of technology, as well - even of SAP, in this particular case. This is one sense.

On the other side, since we are pooling more and more data in an automated way, in the past, this required a big part of the team to bring together the information. Now, you have more time to analyse, or you have a massive amount of information and data, but now you have to be in a position to pull the right information and make the information visible to others for decision making.

Normally, you have too much information in the meantime, so you have to say what is the right one you’re looking for.

Also, in the past, you had the silos - you have the Finance people, the Treasury people, the IT people, the SAP people, etc., and everybody was working in silos. In the meantime, we have to overcome the silos so that the Finance people and the Treasury people can speak with the relevant IT people on the outside.

The IT people need to understand our processes, how we are thinking, whereas we need to understand how the technology works on the other side. Therefore, yes, technology has already changed and will change the profile of the candidate even further; what they need to learn, what they need to bring to be a valuable member of a highly-dedicated Finance environment or team.

Are you quite flexible when you’re hiring someone for the team if they lack a little bit in the IT side? Are you willing to train them on that?

Sure. In the end, it’s quite specific technology you are using in your company; even if you hire a Treasury person from another industrial company, they are not using the Treasury management system we are using and the same consultation tool. Therefore, they only need to have the capability to adapt themselves in a certain period of time to the new environment.

I even have a team member who is 64 and they are very good with technology; they have really learnt and developed. It’s the same for the younger ones who are digital natives compared to the older colleagues, but - in the end - it’s a team effort; everybody supports each other.

For sure, our official IT guy within the team is one of the younger colleagues we have. But to keep up to speed on technology is not easy.

Even in discussions with the CFO and CEO - in the past, we discussed figures; now, we’re talking about processes. To get an understanding of processes, you need a lot of technology know-how and digitalisation. You also need to be aware of the type of technologies coming in the future. Technology and digitalisation are moving so fast - it doesn’t sleep. I think it’s the right development; it will help to free up time of the team members, but it is not making our life less complex.

The expectation of certain senior management, when all the information is there, is that finding the right information to connect the dots is just an easy walk in the park. In the past - and this is also common somehow with cloud solutions - you always had the need to have everything within your own IT department. Therefore, they had to keep up with your technology, as well.

Whereas, in the meantime, if you buy a software you’re using and the software is maintained in a cloud, there is hardly any connection to your IT department. The maintenance, the updates and the software are handled by the outsourcing partner. You make yourself more independent and it might cost less than having your own IT department.

You are also not dependent on the resources and constraints you might have within IT. This also gives more flexibility, and the integration of new software and new technologies is easier with this. It is a wide range of various aspects, but clearly it is coming in more and more.

Thank you to Holger for speaking to Lauren Eagar, Senior Consultant in our Finance & Accoutancy recruitment team in Switzerland.

Views and opinions contained within our Executive Interviews are those of the interviewee and not views shared by EMEA Recruitment.

You can also use your social account to sign in. First you need to:

Accept Terms & Conditions And Privacy Policy